In Saudi Arabia, business growth often looks strong on paper: contracts signed, invoices issued, and new projects opening across Riyadh, Jeddah, and Dammam. Yet when the Saudi Riyal (SAR) cash cycle tightens, reality hits hard — profits don’t always translate into liquidity.

With extended customer credit terms, delayed collections, and supplier payment schedules overlapping, even well-run Saudi companies can suddenly find themselves asking: “If we’re growing, why does our bank balance feel so tight?”

Across the Kingdom, CEOs and finance leaders manage more than just profitability. They must navigate payment timing, cash commitments, GOSI payroll obligations, and ZATCA compliance for VAT, Zakat, and Corporate Income Tax. One overdue customer payment can quickly impact salaries, vendor trust, or approvals for critical bank facilities.

That’s why the cash flow statement matters. This guide will help you read it clearly, spot risks early, and make stronger financial decisions that keep your Saudi business confident, compliant, and cash-ready for growth.

A cash flow statement is a financial report that shows how real cash moves through your business; not just what’s recorded in accounting entries.

It reveals whether your company has enough SAR liquidity to manage daily obligations, pay GOSI-linked salaries, settle suppliers, and remain compliant with ZATCA requirements.

Unlike profit figures, a cash flow statement shows what’s actually in hand and what’s coming in. In Saudi Arabia, where payment timing plays a major role in financial stability, this visibility is critical.

Here’s how smart leaders use the cash flow statement to stay ahead:

The real insight lies in how cash moves, which brings us to the structure of the cash flow statement.

A cash flow statement explains why your SAR position changed, not just that it changed. Each section answers a different financial question.

Here are the main components you’ll see on a standard cash flow statement:

How these components are presented depends on the format your business uses.

A cash flow statement can be prepared in two formats. Both include the same components, but the way operating cash is calculated differs.

Here’s how each format works for Saudi businesses.

A straightforward view of how cash is earned and spent in operations.

What it shows: Actual cash coming in from customers and going out to suppliers, staff, and utilities.

How it appears: Collections and payments are listed line by line for full visibility of Saudi Riyal inflows and outflows.

Why Saudi teams use it: Helps track the real timing of customer collections and supplier payments, especially when managing extended credit terms, milestone-based billing, and delayed receivables common in Saudi business environments.

A profit-led view converted into true operating cash.

What it shows: Net profit adjusted for non-cash items and working capital changes.

How it appears: Depreciation, receivables, and payables are added or removed to reveal the actual cash impact.

Why Saudi teams use it: Aligns with IFRS-based accounting records and audit practices in Saudi Arabia, making it easier to report consistently while still presenting a clear view of real liquidity.

%20(2).png)

Also Read: ERP Finance Cycle: Key Components and Stages Explained

Choosing the format is just the starting point; the real value comes when your team can prepare a clear, consistent cash flow statement from your own numbers.

Preparing a cash flow statement in Saudi Arabia is not just a bookkeeping task. Under IFRS and ZATCA regulations, your financial statements must clearly show how cash and cash equivalents move through the business, classified into operating, investing, and financing activities.

When your team follows a consistent process, this statement becomes a reliable tool for managing Saudi Riyal liquidity, GOSI payroll commitments, and future Zakat and Corporate Income Tax planning.

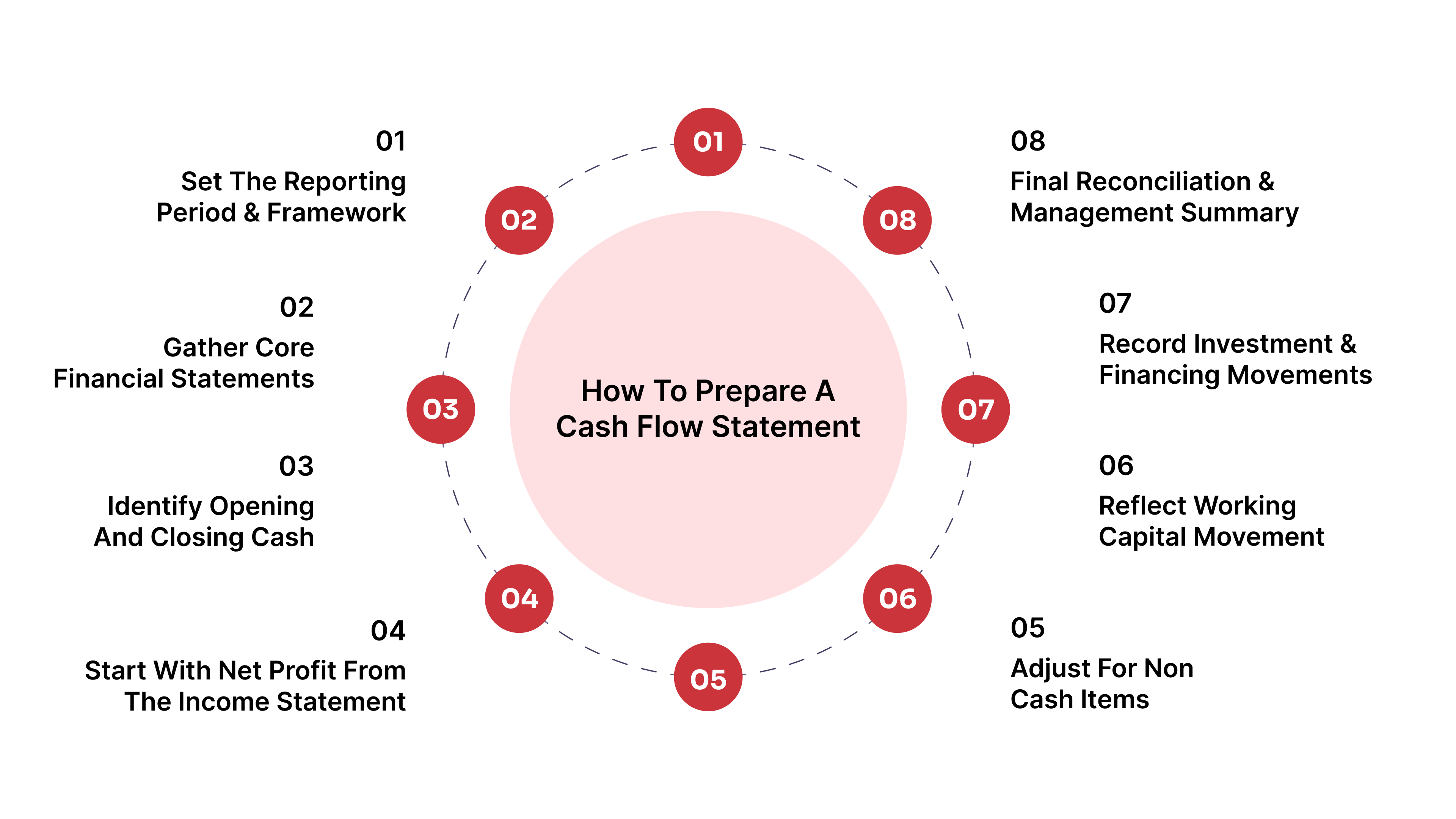

Here is a practical step-by-step structure your finance team can use.

Start by defining the scope so everyone is working with the same numbers.

Period: Decide if you are preparing a monthly, quarterly, or annual cash flow statement.

Framework: Confirm that financials are prepared under IFRS or IFRS for SMEs, as required under Saudi regulatory and ZATCA reporting expectations.

Alignment: Make sure your cash flow period matches the period in your income statement and balance sheet.

You cannot build a cash flow statement without solid source data.

You need a clear view of the cash position at the beginning and end of the period.

For most Saudi companies, cash flow from operations is prepared using the indirect method.

Now convert accounting profit into a more cash-based view.

Now assess how much cash is tied up in everyday business:

This shows the impact of customer credit terms and supplier payment cycles common in Saudi business environments.

Separate long-term and borrowing activity from operations:

This helps leadership see whether growth is funded through operating profits or external financing.

Bring everything together:

This turns the cash flow statement from a compliance document into a practical cash intelligence tool.

Suggested Read: Understanding Withholding Tax in Saudi Arabia: Key Rules and Guidelines

With the statement in place, the next step is understanding the story your cash is actually telling.

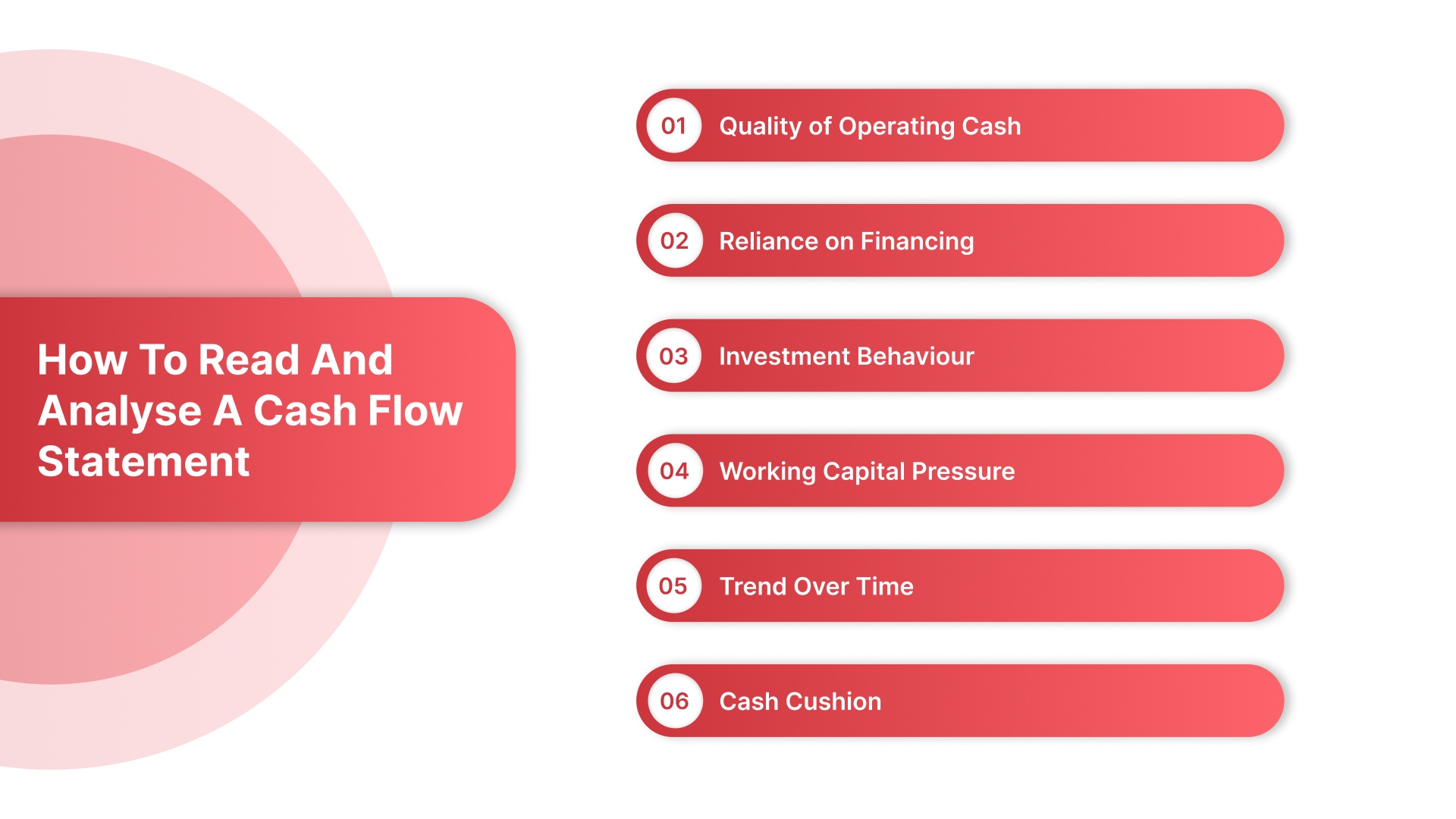

Profit can look healthy while cash is under pressure, so this statement helps you see whether liquidity is strong enough to support daily operations and growth. Since it separates operating, investing, and financing cash flows, it also shows whether the business is being funded through core performance or ongoing reliance on borrowing.

You can read and analyse it through these lenses:

That clarity becomes even stronger when your systems track cash movement automatically, which is where HAL ERP steps in.

Many businesses struggle with fragmented tools; separate spreadsheets for sales, receivables, supplier payments, payroll, and expenses. In fast-moving Saudi markets, this often means delayed cash visibility, messy manual reconciliations, and frequent uncertainty over Saudi Riyal (SAR) liquidity.

By the time month-end arrives, you might know your sales are good, but not whether you have enough cash to run GOSI payroll, settle suppliers, or invest in growth.

That’s where HAL ERP steps in to change the game.

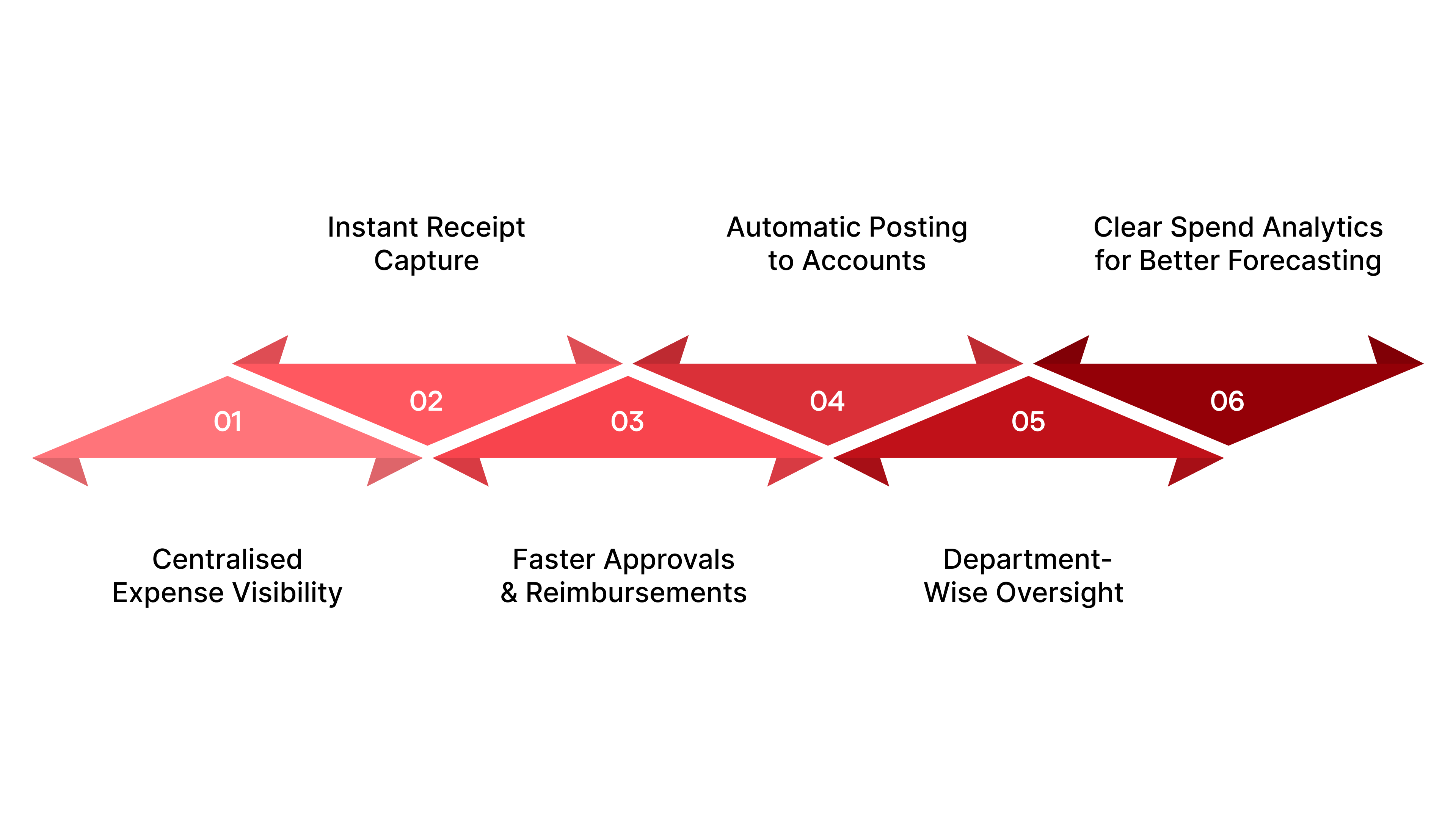

1. Centralised Expense Visibility:

All employee expenses, receipts, and claims sit in one place inside HAL ERP.

No missing bills, no waiting for manual updates. Finance teams always know how much cash is being spent right now, not weeks later.

2. Instant Receipt Capture for Faster Cash Updates:

Receipts can be attached directly in the system from mobile snapshots, email uploads, or the web.

The moment an employee spends, that expense reflects in your system, keeping cash tracking accurate even during travel or field work.

3. Faster Approvals and Reimbursements:

Expense claims move through a guided approval flow inside HAL: managers review, comment, approve, or decline in clicks.

This stops reimbursements from piling up and gives finance earlier visibility of upcoming cash payouts.

4. Automatic Posting to Accounts:

Once approved, HAL converts expenses into journal entries automatically.

No delays from manual bookkeeping, which means your cash reports update in real time and reconciliation becomes easier at month-end.

5. Department-Wise Oversight to Control Spending:

All budgets, expense categories, and spend limits can be monitored by finance and department heads.

If a team is overspending, you catch it before cash flow tightens — not after the month closes.

6. Clear Spend Analytics for Better Forecasting:

HAL gives detailed expense reports showing where cash is going: travel, operations, marketing, projects, etc.

Leadership can forecast future cash outflows with confidence instead of reacting to surprises.

Having seen how HAL ERP standardises and streamlines expense and cash-flow processes, it helps to understand its impact in real life. The story of Al Faneyah shows how powerful that clarity can be.

Before implementing HAL ERP, Al Faneyah, a contracting & electro-mechanical firm, relied on manual, Excel-driven workflows. Quotation tracking was inconsistent, procurement and purchase-order approvals were slow, and payment and document tracking were error-prone.

Finance lacked real-time visibility into project costs, margins, and budget compliance. This resulted in lost enquiries, overspending, delays, and revenue leakage.

How HAL ERP changed things:

Results & Return on Investment (ROI):

As a result of these changes, Al Faneyah unlocked 3.6 – 5.5 million SAR per year in savings and improved operational efficiency.

Why this matters to you:

For businesses juggling multiple projects, supplier credit terms, and Saudi Riyal cash cycles, just like Al Faneyah, HAL ERP turns unpredictable cash flows into predictable, controllable operations.

It ensures procurement, project costs, and payments are tracked live, reducing the risk of overspend, missed collections, or cash shortfalls.

Suggested Read: Bill of Materials (BOM) in Construction: Types, Creation Steps and Benefits

Cash flow is not just a finance task in Saudi Arabia. It is what keeps your business trusted by suppliers, compliant with Zakat and Corporate Income Tax obligations, and ready for new opportunities without last-minute stress. The smartest leaders today treat cash visibility as a daily habit, not a monthly reconciliation, because confidence in your Saudi Riyal position gives you confidence in every decision you make.

And when that visibility comes built-in, like with HAL ERP, you don’t just track cash; you run a stronger business. HAL enables real-time clarity on every expense, approval, and project cost, so you can focus on growth while your system safeguards liquidity. If companies like Al Faneyah can turn hidden leaks into multi-million-Riyal savings, your business can too.

1. How often should a Saudi business prepare a cash flow statement?

Most companies review it monthly to stay ahead of payments and collections, and quarterly for board or lender reporting. Regular tracking helps prevent surprises around GOSI payroll, rent, and ZATCA VAT filing deadlines.

2. What is the main difference between a cash flow statement and a profit & loss statement?

A profit & loss statement shows profitability. A cash flow statement shows actual Saudi Riyal (SAR) movement, indicating whether you have enough cash on hand to run the business smoothly.

3. Which cash flow statement format is better for Saudi businesses?

Both the Direct and Indirect methods are acceptable. Most companies use the indirect method because it aligns with IFRS-based accounting records and audit practices in Saudi Arabia, while still revealing real liquidity.

4. How can delayed customer payments affect cash flow?

When receivables increase but cash doesn’t, the business may appear profitable yet struggle to pay suppliers or salaries on time. Even one delayed payment can disrupt Zakat, VAT, or Corporate Income Tax planning if cash buffers are weak.

5. How does HAL ERP improve cash flow management?

HAL ERP updates expenses, approvals, and financial transactions in real time. This gives finance leaders instant visibility into upcoming cash outflows and reduces reliance on manual reconciliation.