Have you ever noticed a mismatch between your financial statements and the cash in your bank account? Or wondered why auditors pay so much attention to when and how you recognize revenue? Revenue recognition isn’t just an accounting task; it’s the backbone of your business’s financial accuracy and credibility.

For businesses in Saudi Arabia, getting it right is even more critical. With a VAT rate of 15%, mandatory IFRS 15 compliance for listed companies, and growing digital adoption, proper revenue recognition ensures compliance, transparency, and better decision-making.

In this blog, we’ll break down the core concepts, explore key methods, and share best practices so you can manage your revenue with confidence.

Revenue recognition is the accounting principle that defines when and how income should be recorded. In simple terms, it’s about knowing the right time to record revenue from sales or services.

For small businesses and startups in Saudi Arabia, using the correct revenue recognition method ensures financial statements accurately reflect performance while complying with IFRS 15.

It also plays a crucial role in tax compliance, as businesses must follow Zakat, Tax, and Customs Authority (ZATCA) regulations, including Value Added Tax (VAT) at 15% and e-invoicing requirements. Errors in recording revenue can lead to penalties, audits, and other compliance issues.

Correct revenue recognition helps you make informed decisions, plan growth strategies, and maintain investor and stakeholder confidence. The real challenge is understanding how it works in practice, so your books reflect the true picture of your business.

Also Read: Understanding Revenue: Definition, Formula, and Examples

Revenue recognition is about knowing when and how your business should record income. You recognize revenue once you’ve fulfilled your obligation to a customer, but the timing depends on your business type and chosen accounting method.

For example, a retail shop in Riyadh records revenue immediately when a customer makes a purchase. In contrast, a construction or engineering company working on a multi-year project recognizes revenue gradually, as each milestone or project phase is completed.

To choose the right approach, businesses typically rely on either cash accounting or accrual accounting, depending on size, complexity, and regulatory requirements.

1. Cash Accounting

Cash accounting records revenue only when payment is received. For instance, if you deliver a service in April but receive payment in May, revenue is recorded in May.

This method is simple and commonly used by small businesses and freelancers. Since transactions are recorded only when cash changes hands, there’s no need to track accounts receivable or payable.

However, cash accounting doesn’t capture pending invoices or upcoming obligations, providing an incomplete financial picture. It’s fine for small businesses focused on immediate cash flow, but it’s limited for growing businesses or those required to comply with IFRS.

Most medium and large Saudi businesses use accrual accounting, as required under IFRS. This method records revenue when it is earned, regardless of when payment is received.

Accrual accounting gives a more accurate view of your financial performance by matching revenue to the period when the work is completed. It also follows the five-step IFRS 15 model, which ensures revenue is recorded correctly, consistently, and transparently.

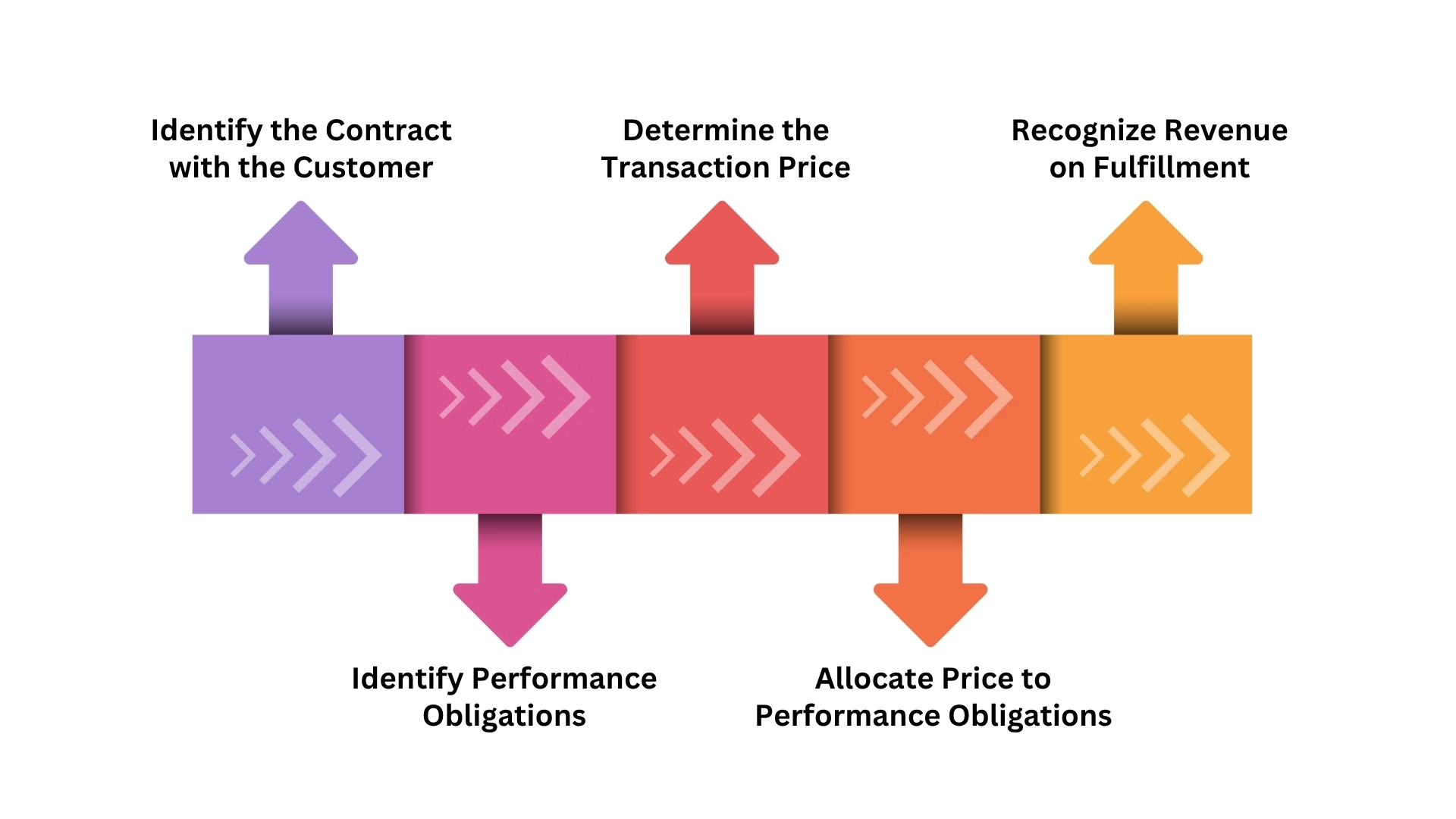

Revenue recognition might sound simple, record income when you earn it, but IFRS 15, adopted by SOCPA, requires a structured five-step process. This framework ensures businesses record revenue consistently and transparently, whether they’re retail chains, construction firms, or software providers.

Revenue recognition starts with a contract, a formal agreement that defines the rights and obligations of both parties. Contracts can be written, verbal, or implied, but the terms must be clear and enforceable.

Example: A Saudi construction firm signs a long-term government contract. Revenue is recognized only after confirming scope, payment schedule, and obligations are agreed upon.

Next, determine what your business is delivering. Each distinct product or service in a contract is considered a performance obligation.

Example: A Jeddah-based ERP provider sells software with training and maintenance. Each software license, onboarding, support, may be treated as a separate obligation.

The transaction price is the total amount expected from the customer, including fixed amounts, variable considerations (bonuses, discounts, penalties), or non-cash benefits.

Example: A construction company agrees to build a property for SAR 5 million, with a SAR 200,000 bonus for early completion. The total transaction price ranges from SAR 5 million to SAR 5.2 million, depending on the likelihood of earning the bonus. IFRS 15 requires careful estimation to prevent overstating revenue.

Once the total transaction price is determined, allocate it to each obligation based on its standalone selling price. This ensures financial statements are accurate and prevents revenue from being overstated in any period.

Example: A Dammam tech company charges SAR 100,000 for setup, customization, and annual support. Each service is valued separately according to its fair price.

Finally, recognize revenue when your business fulfills its part of the contract, either over time or at a specific point in time.

Example: A Riyadh-based manufacturer recognizes revenue when goods are delivered, while a consultancy firm recognizes revenue monthly as services are provided.

Implementing this model helps ensure that revenue is recognized in a manner that reflects the transfer of control to the customer. That said, let’s explore the methods businesses actually use to record revenue, and why choosing the right one can make a big difference.

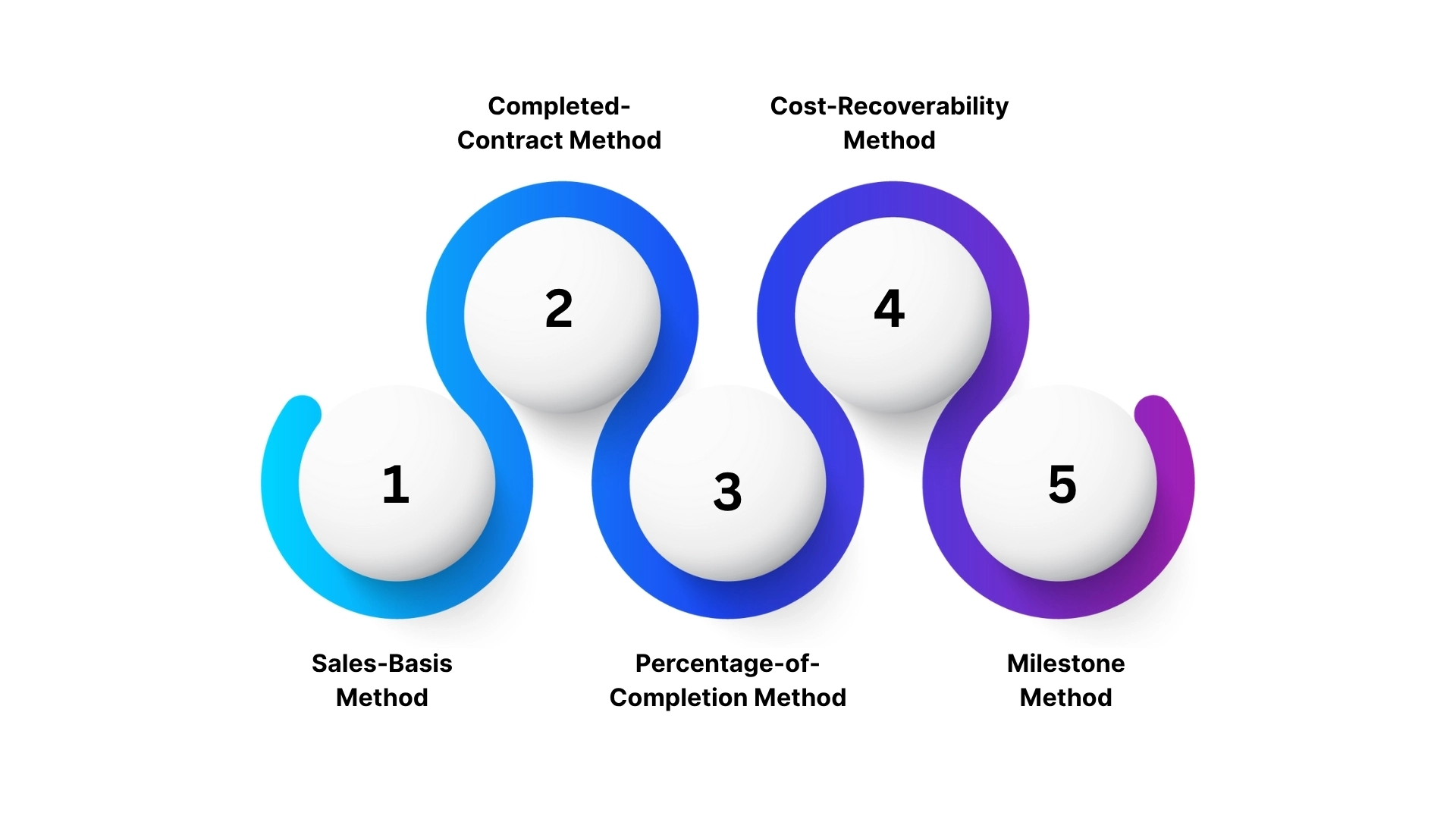

Not all businesses recognize revenue the same way. The method you choose depends on your industry, business model, and regulatory requirements. Using the right approach ensures your financial statements accurately reflect performance while staying compliant with IFRS 15 and Saudi regulations.

1) Sales-Basis Method: Revenue is recorded when the sale occurs and ownership transfers to the buyer. This simple method works well for retail businesses or those delivering goods immediately, such as shops in Riyadh or Jeddah.

2) Completed-Contract Method: Revenue and expenses are recognized only once a long-term contract is fully completed. Common in construction or large-scale projects, this method defers recognition until the project is finished.

3) Percentage-of-Completion Method: Revenue and expenses are recognized proportionally based on the percentage of work completed. Suitable for long-term projects, it provides a more accurate picture of financial performance over time.

4) Cost-Recoverability Method: Profit is recognized only after all project costs are recovered. This method is used when there’s uncertainty about receiving payment, ensuring revenue is recorded only when it’s likely to be collected.

5) Milestone Method: Revenue is recognized as predefined milestones are achieved during a project. Common in sectors like software development, consulting, or engineering, it helps track progress and revenue systematically.

Choosing the right method aligns revenue with actual business performance, enhances transparency for investors, and ensures compliance with Saudi accounting standards. But, to keep your reporting accurate and compliant, you need proven practices that make revenue recognition reliable and stress-free. Let’s explore these next.

Also Read: Understanding Profit and Loss Statement Basics and Examples

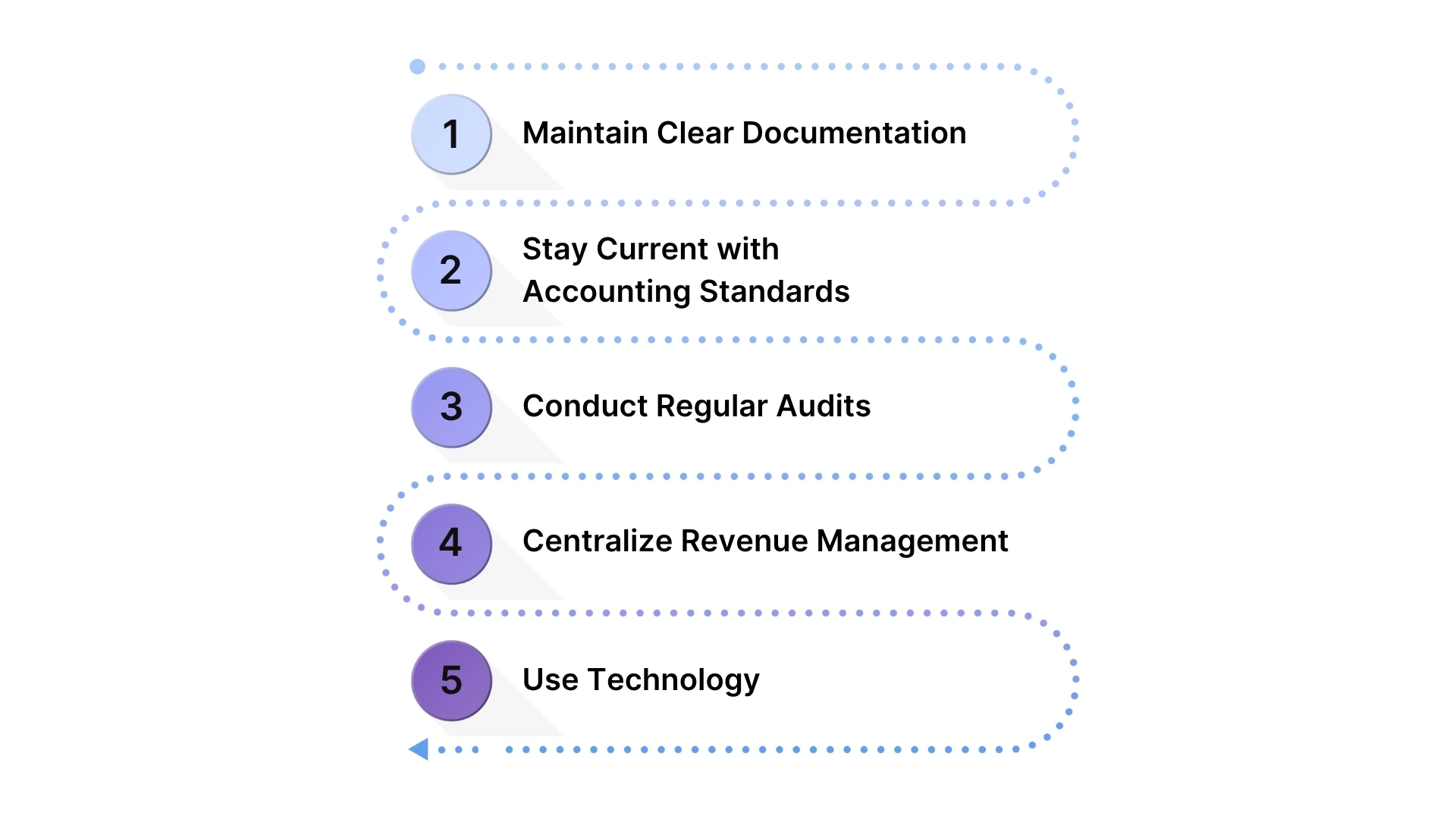

Accurate revenue recognition is key to compliance and building trust with investors, auditors, and regulators. To ensure your financial statements reflect your true business performance, consider these best practices:

1. Maintain Clear Documentation: Ensure contracts clearly outline performance obligations, milestones, and payment terms. Detailed documentation makes it easier to determine when and how to record revenue, especially for long-term or milestone-based projects.

2. Stay Current with Accounting Standards: Align your revenue recognition practices with IFRS 15 and SOCPA guidelines. Keeping your team informed of regulatory changes helps prevent errors and ensures compliance.

3. Conduct Regular Audits: Frequent internal audits help identify discrepancies, verify compliance, and ensure revenue reporting is accurate. Reviewing contracts and financial entries regularly prevents misstatements and audit issues.

4. Centralize Revenue Management: Managing all revenue data in a single system improves transparency, simplifies audits, and provides a complete view of contracts, payments, and obligations.

5. Use Technology: ERP systems like HAL ERP automate revenue recognition, track contracts, and allocate revenue accurately. Automation reduces manual errors and provides real-time insights into your financial performance.

Let’s see how HAL ERP helps simplify these processes, automating compliance and giving you real-time financial visibility.

HAL accounting is built to meet the unique needs of startups, small and midsized businesses in Saudi Arabia, offering accurate, compliant, and efficient revenue recognition.

With HAL ERP, you can simplify accounting, maintain accurate revenue records, and focus on growing your business. Want to know how HAL ERP can track revenue in real time? Explore case studies to see how Saudi businesses improved accuracy and transformed operations.

Accurate revenue recognition is essential for the financial health and growth of your business. Accurate revenue recognition is crucial for the financial health and growth of your business. Implementing the right methods and best practices ensures your financial statements reflect true performance, maintain investor confidence, and keep you compliant with Saudi regulations.

HAL ERP provides the tools and features you need to streamline revenue recognition, maintain compliance with regulations, and ensure your financial reporting is reliable.

Don’t let revenue recognition challenges slow you down. Streamline your accounting, gain real-time insights, and focus on growing your business with HAL ERP.

Request a demo today and see how HAL ERP can transform your financial operations.

1. What do you mean by revenue recognition?

Revenue recognition is the process of recording income when your business has delivered goods or services to a customer. It ensures that financial statements accurately reflect the company's performance.

2. What are the 5 criteria for revenue recognition?

The five-step criteria under IFRS 15 and ASC 606 are: identify the contract, identify performance obligations, determine the transaction price, allocate the price to obligations, and recognize revenue when obligations are fulfilled.

3. How to understand revenue recognition?

Revenue recognition is understood by linking it to performance obligations. You recognize revenue only when your business satisfies the promised service or delivers the product to the customer.

4. What are the four principles of revenue recognition?

The four core principles are: revenue is earned, measurable, realizable, and recorded in the correct accounting period. These principles guide accurate and consistent financial reporting.

5. What is the IFRS rule for revenue recognition?

IFRS 15 requires revenue to be recognized when control of goods or services transfers to the customer. It uses a five-step model to ensure transparency, consistency, and compliance.

6. How many types of revenue recognition are there?

Common types include Sales-Basis, Percentage-of-Completion, Completed-Contract, Installment, and Cost Recovery methods, each suitable for different industries and contract structures.

7. Can small businesses use cash accounting for revenue recognition in Saudi Arabia?

Yes, small businesses and freelancers can use cash accounting, recognizing revenue only when payment is received. Larger businesses or those under IFRS must use accrual accounting for compliance.